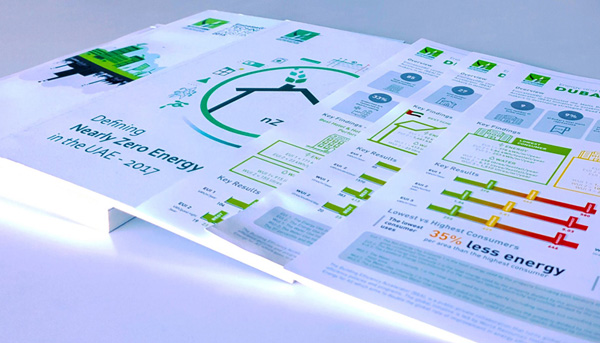

- PUBLICATIONS

-

-

- MEMBERSHIP

The Emirates Green Building Council currently offers five membership levels, which cater to Industry, Corporate, Individual, SME, and Student stakeholders within the Industry

An EmiratesGBC membership allows you and your staff to take advantage of a broad range of technical, educational and marketing benefits.

- Technical Programs

- Events

EmiratesGBC hosts events throughout the year as a platform for collaboration and knowledge sharing across the industry

Join us at one of our flagship events to network with industry leaders or join a project tour to learn about building innovations in the UAE. Both in-person and online, our events provide a forum for discussing the latest green building topics with like-minded professionals.

- Education

EmiratesGBC offers a wide range of training and workshops related to sustainability and green buildings to build capacity in the UAE and wider region.

From our monthly technical workshops to certified training programmes we provide learning experiences to suit both technical and non-technical audiences covering a breadth of green building topics and developments.

- Green Building Tooltips

The EmiratesGBC Green Building Tooltips is a rich online resource that provides useful information on green building practices.

The tooltips serve an audience of varying levels of technical capacity. All three building types are supported by interactive tip boxes that offer sustainability measures, methods, technologies, and behavioral changes that can be exercised by owners and occupants to improve their structures.

Become a Member

Become a Member